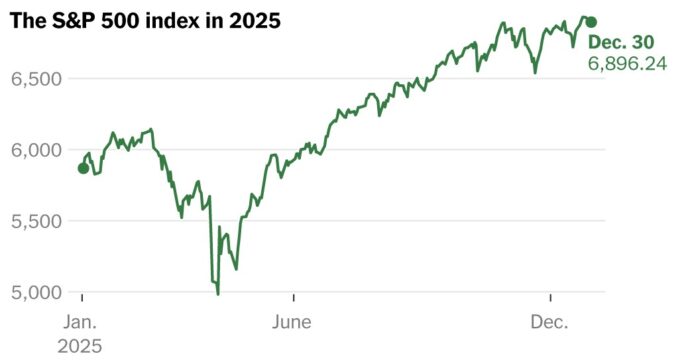

Despite a year filled with economic uncertainty and geopolitical shifts, stock markets closed 2025 with strong gains. The S&P 500 rose 16.4 percent, driven largely by investor confidence in artificial intelligence (AI) as a transformative economic force. This outcome defied initial predictions of a smooth market ascent, as investors navigated a turbulent year marked by shifting expectations and persistent anxieties.

Initial Forecasts vs. Reality

At the beginning of 2025, economists and analysts anticipated steady growth fueled by anticipated interest rate cuts and a supportive policy environment following President Trump’s re-election. While the Federal Reserve did lower rates by 0.75 percent, the path was far from predictable. The market experienced volatility, including a late-year slump with four consecutive days of losses, underscoring the fragility of early optimism.

The AI Factor

The primary catalyst for the year’s rally was the growing conviction that AI represents a generational investment opportunity. Investors bet heavily on the massive capital expenditure required to build and maintain AI infrastructure, as well as the potential for significant productivity gains across industries. This sentiment effectively overshadowed concerns about economic weakness and rising cost-of-living pressures.

“If technology felt good, equities were on a tear,” notes Cindy Beaulieu, chief investment officer at Conning. This highlights the outsized influence of tech-sector performance on broader market sentiment.

Broader Economic Context

While the stock market thrived, underlying economic conditions remained uneven. Although the economy appears stable, there are growing concerns about income inequality and the impact of inflation on low-income households. The surge in stock values doesn’t necessarily reflect widespread economic improvement, but rather a concentrated bet on the future profitability of AI-driven companies.

This divergence between market performance and real-world conditions raises questions about whether current valuations are sustainable in the long term. The reliance on a single technological narrative—AI—creates inherent risks if growth expectations are not met or if alternative economic shocks emerge.

In conclusion, the 2025 stock market rally demonstrates the powerful influence of technological optimism, even in the face of broader economic anxieties. The market’s performance suggests that investors are willing to overlook systemic challenges in pursuit of high-growth opportunities, particularly those tied to AI.